- 11 July 2024

- Posted by: Admin

- Category: GST

GST on Renewable Energy: India’s Renewable Energy Future

Renewable energy refers to energy derived from natural sources that replenish themselves over short periods of time. These sources include sunlight, wind, rain, tides, and geothermal heat. India is a significant player in the renewable energy sector, ranking third worldwide in renewable power capacity. The Indian government actively promotes renewable energy through initiatives like the National Solar Mission and extensive subsidies and incentives. Additionally, India has set ambitious targets, aiming to reach 450 GW of renewable energy capacity by 2030, emphasizing its commitment to sustainable development.

In addition to its ambitious targets and initiatives, India has also taken steps to support the renewable energy sector by addressing issues such as GST on Renewable Energy, aiming to streamline taxation and reduce operational costs for renewable energy projects.

What is Renewable Energy?

Renewable energy refers to power sourced from natural processes that replenish at a rate faster than they are consumed. Various types of renewable energy include:

1. Solar Energy: Harnesses sunlight using photovoltaic cells to produce electricity.

2. Wind Energy: Utilizes wind turbines to generate power.

3. Hydroelectric Power: Employs flowing water to turn turbines for electricity generation.

4. Biomass Energy: Converts organic materials into energy.

5. Geothermal Energy: Uses heat from beneath the Earth’s surface for power and heating.

Unlike fossil fuels, which produce harmful emissions, renewable energy is considered clean as it generates little to no greenhouse gases. This sustainability aspect makes it crucial for combating climate change and reducing air pollution. The versatility and sustainability of renewable energy technologies, such as solar panels, wind turbines, and hydroelectric facilities, support a transition towards a more environmentally friendly and resilient energy system.

GST on Renewable Energy

In July 2017 Goods and Services Tax law was introduced in India. Since the law’s inception, electricity sales have been kept as exempted supplies vide notification no. 02/2017-Central Tax (Rate) dated 28th June 2017. On the other side the transmission of electricity is considered as services and exempted vide notification no. 12/2017-Central Tax (Rate).

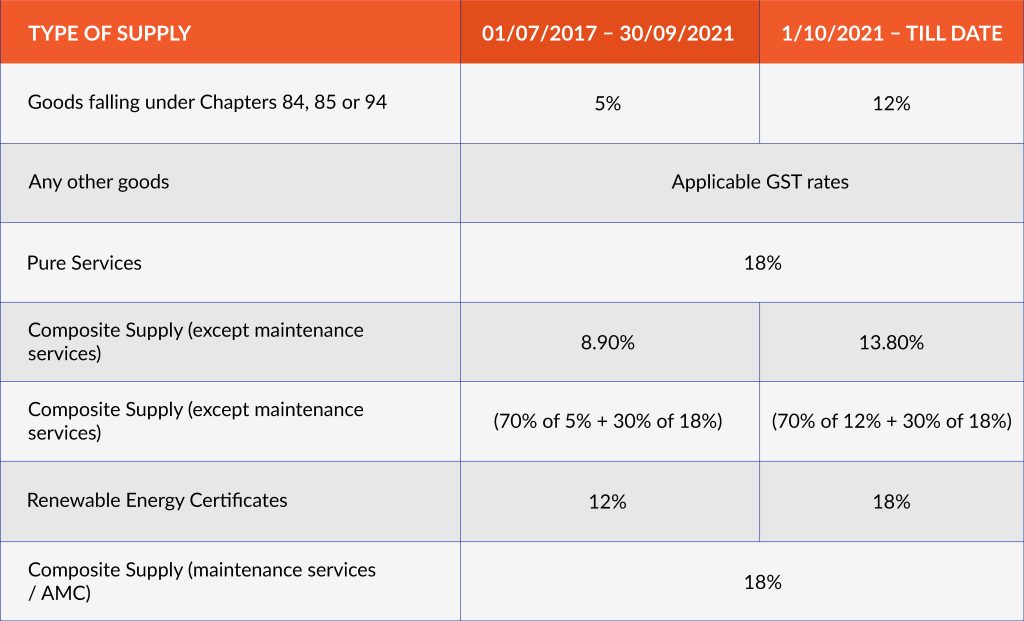

The Notification no. 24/2018-Central Tax (Rate) and further clarification vide circular no. 163/2021-GST provide the 70:30 ratio applying for supply of goods and services respectively in relation to renewable energy, with effect from 1st January 2019.

Various GST on renewable energy devices or supply of services for renewable energy are:

Input Tax Credit on supply of goods and services related to renewable energy.

Manufacturers of Renewable Energy Devices: Businesses that produce Renewable Energy goods or devices are eligible to claim the ITC subjects of conditions in Section 16 and restriction in section 17. Many a times these manufacturers are entirely indulge in the manufacture and sale of complete units such as Solar Panels, Wind turbine fans, etc.

Dealers/Contractor of Renewable Energy goods and services: All the businesses involved in the procurement and installation of Renewable Energy goods and services will be eligible for claim of ITC subject to restriction of 17(5)(c). There is a procurement of input goods and services in the regard, as the effective GST on renewable energy for supply is currently 13.08% whereas the possibility of goods does not fall under 84, 85, or 94 and individual services may attract higher GST rates.

End Customer of Renewable energy goods: Businesses that secure renewable energy-related goods or services for their business will be eligible to claim ITC as follows:

1. Factories / Commercial buildings:

For renewable energy units installed in factories or commercial buildings for captive electricity generation, the restrictions under Section 17(5)(c) and (d) of the CGST Act, 2017 concerning building construction do not apply. These units are classified as ‘Plant and Machinery’ rather than ‘Building’.

2. Sale of captively generated electricity:

If a business entity generates more electricity than it needs, the supply of this surplus electrical energy is exempt from GST. Therefore, any common input tax credit (ITC) used for generating this electricity, including ITC on renewable energy units, must be reversed according to Rule 42 for input goods and services and Rule 43 for capital goods.

3. Generation and sale of electricity:

All the businesses involved just in the generation and sale of electricity in the market, then the sale of electrical energy will be included in the sale of goods as per notification no. 02/2017 dated 28/06/2017. Thus, in Section 17(3) and Rule 42/43, the input tax credit incurred for such exempt sale shall be reversed accordingly. Therefore, the input tax credit incurred will be the project’s cost and impact the electrical energy pricing. As the GST rates increased by 4.9% on composite supply of renewable energy goods, the cost of such businesses for setting up the project has increased a lot.

4. In all other cases, ITC is eligible for claim as per Section 16 and Section 17 of the CGST Act, 2017.

Important Judgements and Rulings for GST on Renewable Energy

Claim by ITC and treatment of capitalized Solar Power Plant in the factory:

The ARA held that the solar power plant must be fastened to the rooftop of the building and would require construction/erection of pillars for the same. Hence, it is ‘permanently fastened to anything attached to the earth’. Further, as per Section 17(5)(d) of the CGST Act, 2017, the solar power plant will be considered an immovable property but would qualify as a ‘Plant and Machinery’ and hence, is eligible for ITC claim under GST. M/s. Pristine Industries Limited – Rajasthan AAR (No.- RAJ/AAR/2021-22/16 dated 13/09/2021)

Concessional Rates Applicable to Sub-Contractors of Solar Power Generation Systems

The Karnataka Advance Ruling Authority has determined that sub-contractors are eligible for concessional rates, as the notification makes no distinction between contractors and sub-contractors. Hence, sub-contractors supplying solar power generation also qualify for these reduced rates. Therefore, the concessional rates are applicable to sub-contractors as well provided they are supplying a solar power generation system.

Comment: This ARA’s ruling states that even sub-contractors can avail themselves of the benefit of concessional rates. However, proper care and precaution must be taken in drafting the contracts. Sub-contractors may also exercise additional safeguards to ensure that the goods they supply are for construction of solar power generation systems only. M/s. Solarsys Non-Conventional Energy Private Limited – Karnataka AAR (KAR ADRG 120/2019 dated 30/09/2019)

Waste to Energy Plant (WTEP) is classified on the basis of not just the name of the product but also the technical specification:

The Advance Ruling Authority (ARA) of Gujrat has held that to classify a product as a WTEP liable to a GST rate of 5% should be based on the technical specifications. The product cannot qualify for concessional rates simply by being presented as a WTEP. It uses coal as fuel, as indicated on their website, a fact intentionally omitted by the Applicant. Therefore, the applicable GST rate is 18%.

Comment: The AAR shows that classifying supplies as Renewable Energy devices must be backed by proper proof and even details such as technical specifications and details disclosed on the websites or other sources which is available to the public will be considered before providing concessional benefit. M/s. Isotex Corporation Private Limited – Gujrat AAR (GUJ/GAAR/R/74/2020 dated 17/09/2020)

Critical analysis on the implication of GST on EPC Contracts in the Renewable Energy sector

The huge challenge in the renewable energy project’s taxation area is the wide use of the EPC modality. The GST legislation categorizes EPC contracts that involve composite supply that leads to immovable property under the category of works contracts, hence attracting 18% GST on the contracts. This categorization will affect the cost structures of the projects a lot; hence, it will be important for the tax liabilities to be managed effectively. Input tax credit of inward supplies in terms of work contract services would have its limitations due to the restricted clause of blocked credit.

In such a scenario, when the entity has not fixed the place of business in the territory and will likely make a huge initial capital expenditure on research and development of the project, this is likely to add up to the cost of the project in terms of Input Tax Credit. Finally, this will result in the increased cost of the final product due to territory-based taxation law.

The Indian government should have formulated some kind of tax mechanism, under which the final output is liable to tax, with no break in the supply chain, and the final benefit reaching the end consumers.

Embracing a Sustainable Future: The Vital Role of Renewable Energy in India’s Development

As we wrap up our exploration of renewable energy in India, it’s clear that this sector isn’t merely an alternative but a cornerstone of the nation’s energy strategy. India’s ambitious target of reaching 450 GW of renewable energy capacity by 2030 reflects its strong commitment to sustainable development and environmental stewardship. The government’s proactive initiatives, including the National Solar Mission and fiscal incentives, are laudable steps towards building a resilient renewable energy infrastructure.

This transition is reshaping India’s economic and environmental landscapes. Embracing technologies like solar panels and wind turbines enhances energy security while reducing reliance on imported fossil fuels. The evolving GST framework, particularly regarding renewable energy, influences pricing and investment decisions, underscoring the sector’s significance.

India faces both challenges and opportunities in renewable energy, necessitating ongoing innovation, supportive policies, and societal involvement. By steadfastly pursuing renewable energy, India contributes to global climate efforts and secures a greener, sustainable future for generations ahead.